In the finance industry, Know Your Customer or KYC is a vital process in managing fraud risk, allowing financial institutions to verify their client’s identity and assess potential risks. The core of KYC processes lies in the collection and verification of KYC documents.

Let’s dive deeper into KYC documents – what they are, why they are required, and the specific types of documents financial institutions require.

What are typical KYC Documents?

You likely already know what KYC is – the process of verifying a client’s identity and address, as well as the risk profile. This process allows companies to detect fraudulent activity early, and it is anchored on the documents clients provide.

“KYC documents” means “Know Your Customer” documents. These are various forms of identification and verification companies require from their clients so they can confirm their identity, address, and sometimes financial standing before conducting business.

These documents are essential in creating a customer profile that helps companies assess the various risks associated with each client, thus ensuring their compliance with regulatory requirements and enhancing overall security.

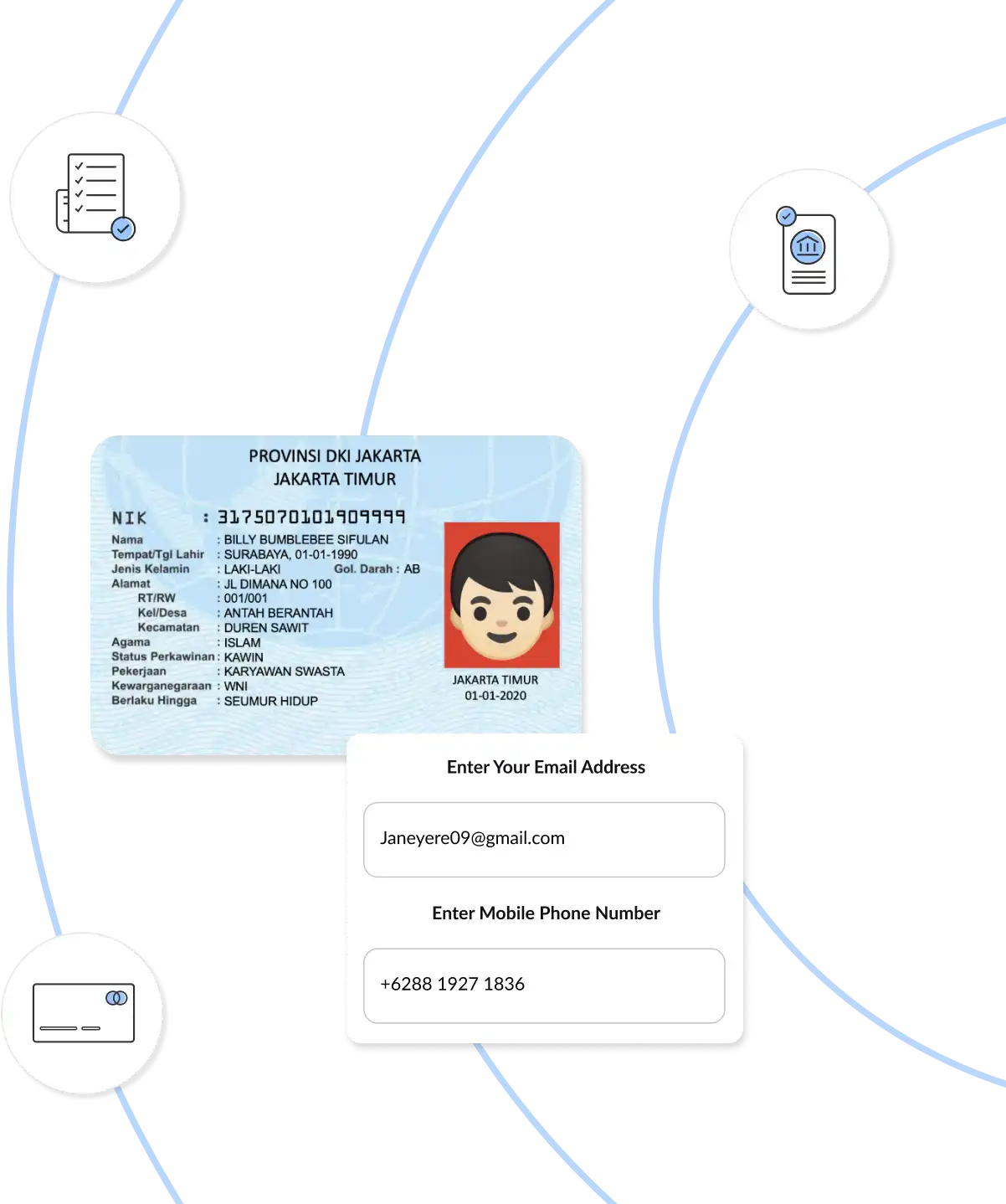

Traditionally, the KYC process involves the client filling out forms and submitting documents in person. However, with eKYC, forms and documentary requirements can be submitted online to be processed by APIs such as those for digital banking.

For Individuals

Proof of Identity Documents:- Passport

- Driver’s license

- Government-issued ID or National ID card

- Voter ID card

- Social security card

Proof of Address Documents:

- Utility bills (e.g., electricity, water, gas)

- Bank statements

- Rental/lease agreements

- Credit card statements

- Property tax receipts

Proof of Income Documents:

- Recent pay slips

- Certificate of Employment

- Bank account statements

- Tax returns

- Business permit (for business owners)

For Businesses

Businesses also need to submit Know Your Customer Documents to prove the legitimacy of the business, as well as its financial health

Proof of Existence of Business:- Business Registration or Permit

- Certificate of Incorporation or Partnership Agreement

Proof of Business Identity:

- TIN Number

- Bank Statements

- Credit Card Statement

Proof of Business Address:

- Utility bills (e.g., electricity, water, gas)

- Annual Income Tax Returns

- Bank statement displaying full business address

Why are Know Your Customer Documents Important in Fraud Management?

KYC documents are the cornerstone of KYC verification processes and thus, fraud prevention strategies within financial institutions. Their importance in fraud management includes:

-

Risk Assessment and Mitigation

KYC documents allow businesses and institutions to assess the risk associated with each client. By verifying the identity, address, and financial history of clients, high-risk individuals can be identified early, and appropriate measures can be applied to avoid potential fraud.

-

Detection of Suspicious Activities

Knowledge of clients’ details and behavior supplements a company’s customer due diligence processes, helping them detect unusual activities that may indicate fraudulent behavior, allowing for timely intervention.

-

Regulatory Compliance

For financial institutions and other companies covered by the Anti-Money Laundering Act, KYC checks are mandatory to prevent money laundering and finance of terrorism. Non-compliance results in fines, legal repercussions, and erosion of public trust.

-

Building Trust

Asking for KYC documents demonstrates your commitment to mitigating fraud and protecting your clients, which positions the company as reputable and trustworthy. These can help boost customers’ confidence and loyalty.

Managing and Verifying KYC Documents with API

The integration of Application Programming Interfaces (APIs) has revolutionized fraud management. It allowed companies to automate the collection, verification, and updating of KYC documents, which has minimized dependence on manual processes.

When a client submits their KYC documents, financial data APIs automatically cross-references the data against multiple databases and official records. This reduces the likelihood of human errors while making the process more efficient.

Additionally, APIs help organize the collected data by to ensure easy access throughout the KYC and CDD processes. APIs also help facilitate regular updates to customer information by prompting clients to provide new documents or information whenever necessary.

Using APIs to manage Know Your Customer documents removes the need for manual processes, thus improving efficiency and speed of onboarding without compromising fraud protection efforts.

On the contrary, it supplements fraud management by enhancing the accuracy and consistency of KYC checks. APIs accomplish this by first minimizing human intervention, which in turn reduces the risk of human errors. It also provides real-time verification so institutions can promptly identify and address potential fraud. These capabilities are crucial for maintaining security.

However, APIs come with additional features that enhance security. Services like GoPay Data and Merchant Link use encryption methods and multi-factor authentication to safeguard sensitive customer data during transmission and storage.

Scalability is another benefit APIs offer in the context of fraud management. KYC processes involve handling large volumes of data, and this continuously grows as the organization’s client base grows. Scalability ensures that the KYC process remains effective regardless of the institution’s size, thus guaranteeing continued protection against fraud.

Manage KYC Documents Better with Brankas

Knowing KYC documents' meaning and its relevance in fraud management, it’s clear that they must be managed and protected. By leveraging modern technologies like APIs for lending, the KYC process, particularly providing KYC documents, can be optimized for greater efficiency, accuracy, and security.