Right Choice Finance Implements an Online and Secure Way for Borrowers to Share their Bank Data.

Implemented an online and secure way for borrowers to share their bank data.

Reduced the amount of time it took for borrowers to apply for a loan.

Right Choice Finance Corporation has been actively engaged in offering non-bank loans to businesses and consumers in the Philippines since 2016. The company's primary focus centers on providing unsecured personal and business loans. A key factor contributing to their success is the utilization of a comprehensive business platform that seamlessly integrates their financial products, digital banking software, and HR services. This integration allows them to provide efficient and holistic solutions to their clients, further enhancing their ability to meet the diverse needs of borrowers.

Right Choice Finance is committed to ensuring that its loan products are easily accessible to both Filipinos and Filipino businesses. Their primary goal is to empower their customers to strengthen their credit and gain access to essential credit facilities, all through a single, integrated platform. Right Choice achieves this by prioritizing a seamless and efficient borrowing experience and making financial support readily available to those in need. By focusing on accessibility and efficiency, the company strives to provide a valuable service that empowers individuals and businesses to achieve their financial goals.

Right Choice Finance aimed to enhance the loan origination process, focusing on simplifying it for their customers. Although a centralized credit rating system is still being established in the Philippines, different financial institutions utilize their own set of criteria and procedures to assess and assign credit scores. Right Choice recognized the need for a streamlined system that would expedite the Know Your Customer (KYC) stage during loan application processing. Their objective was to reduce the time required for this crucial step, ensuring a more efficient and user-friendly experience for borrowers.

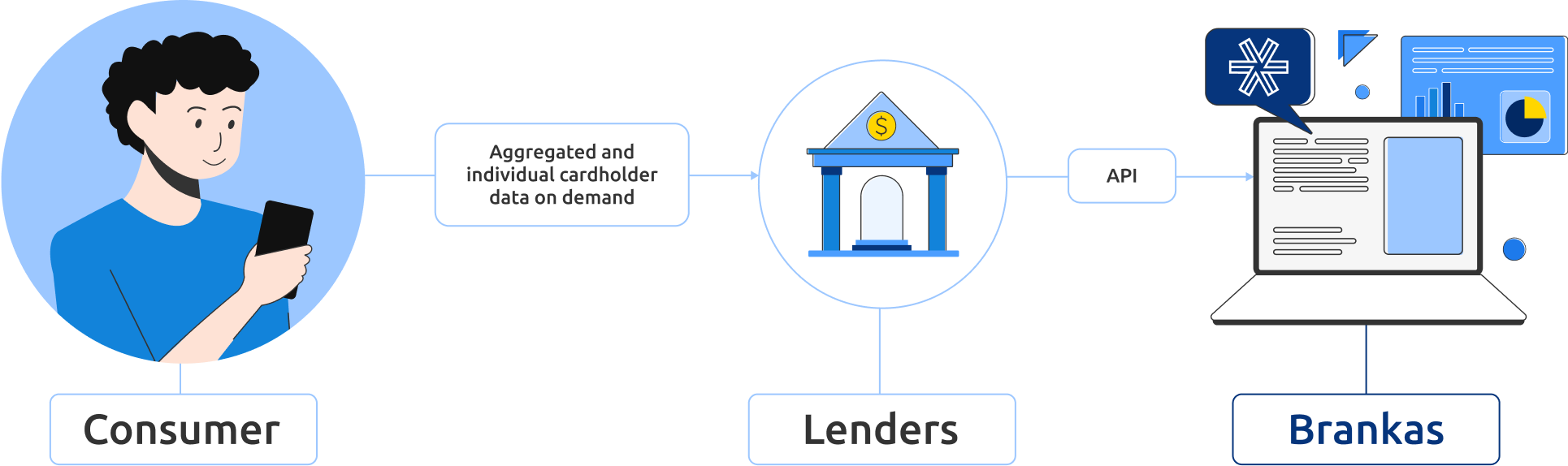

By using the Brankas Bank Data product, RCF gains expedited access to reliable borrower data, allowing borrowers to share their financial information securely and swiftly. This product has been seamlessly integrated into RCF's loan origination process, enhancing the overall borrower experience. As a result, borrowers can enjoy a hassle-free journey, obtaining the required loan amount promptly and efficiently, enabling them to achieve their goals with greater speed and ease. The Bank Data product not only facilitates the efficient flow of data but also contributes to RCF's commitment to providing a streamlined and customer-centric lending experience, which ultimately aligns with the mission and vision of Right Choice Finance to provide holistic and efficient financial services to their clients.

Scale your financial business with Brankas Data APIs.

Join Right Choice Finance and other businesses and provide a faster, better experience to your end-users.