PERA HUB Launches its Digital Remittance Platform using the Brankas Open Finance Suite

Enable faster, cheaper, and safer financial services to the market.

Facilitate fast reviews of new Digital Sub-Agents (DSA) to allow them to instantly consume the APIs.

Share its APIs to banks, remittance companies, wallets, and fintech partners while managing all the partners and endpoints in a single dashboard.

PERA HUB, the new retail brand of PETNET, is geared towards providing complementary products, cash, and payment-related solutions to its growing market. PERA HUB launched a digital remittance platform that allows them to share their API with banks, remittance companies, wallets, and fintech partners, enabling faster, cheaper, safer, and more accessible financial services. PETNET’s mission is to serve the community in the Philippines with an array of transactional financial products and services, such as Western Union money remittance, loans, insurance, payment facilities, foreign exchange, and more, from over 3,000 locations nationwide.

With PERA HUB’s goal to provide better financial services to its community, they wanted a solution that would allow them to scale faster, manage partners effectively, give instant access to their APIs, and facilitate faster reviews of new digital sub-agent (DSA) applications. This would allow them to focus on onboarding DSAs and give them the opportunity to open new revenue channels to earn commissions for every transaction.

PERA HUB aims to be a household name in the Philippines for essential financial services. With Brankas, we are well-positioned to be a leader in driving financial inclusion across the country. Aside from being able to implement the Open Finance Suite more quickly than expected, our partners and we are very impressed with how it has been to use and continuously manage the APIs.

PERA HUB was looking for a solution that would support their goal of becoming a household name in the Philippines for essential financial services. And, in order to make that happen, it would require top-notch technology running in the background, an exceptional customer experience for their end-users, and one that makes it easy for their partners to connect to.

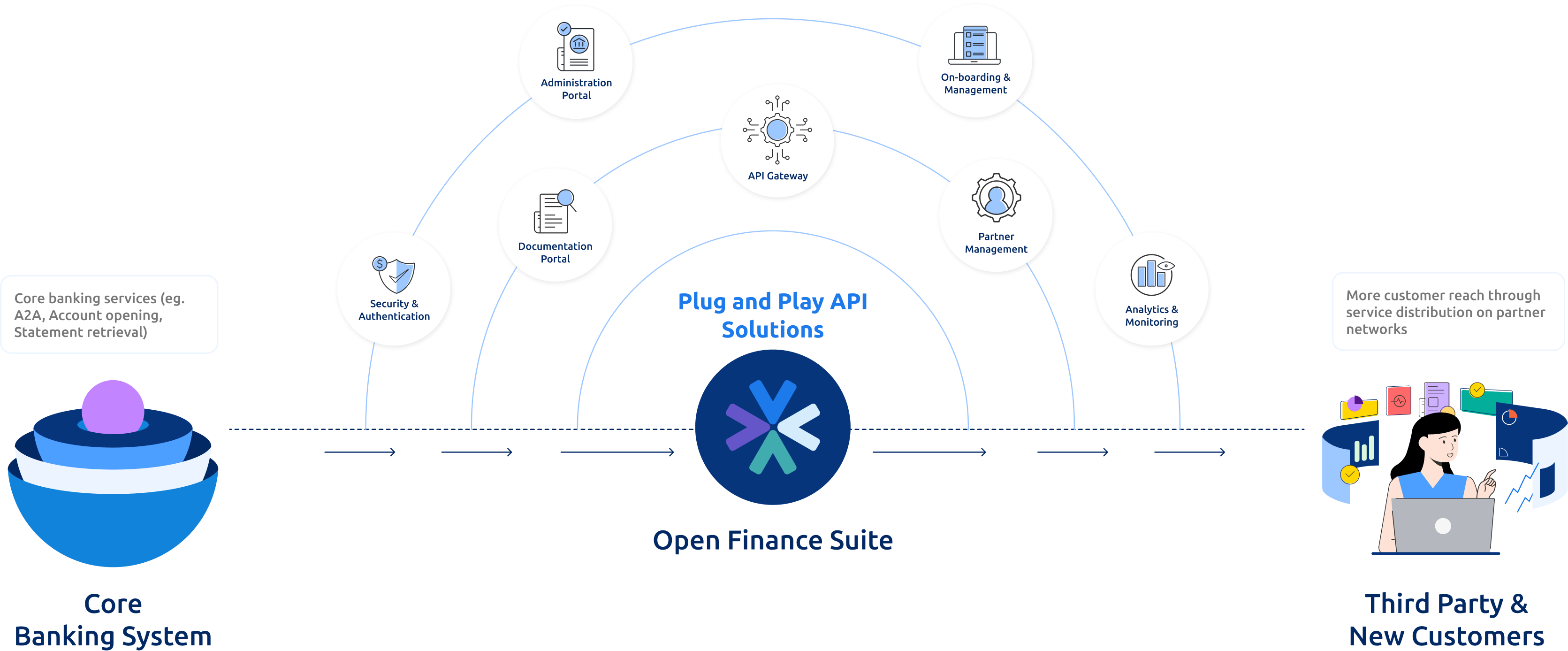

After working with the Brankas team, PERA HUB launched its Digital Remittance Platform on the back of Brankas' Open Finance Suite. This full-scale suite allows banks and institutions to unbundle their banking stack into composable components. These can be sold and offered to third-party service providers to create new financial solutions as they innovate and present new ways to embed relevant financial services to improve the customer experience. Partnering with Brankas has allowed PERA HUB to launch an open API hub that enables them to manage all partners and endpoints from a single dashboard. It also gives them the ability to facilitate faster reviewing of new digital sub-agent applications, which allows the DSAs to instantly consume the APIs. With the Digital Remittance Platform running on the back of Brankas' Open Finance Suite, PERA HUB can now offer financial services that are faster, cheaper, and safer.

Scale your financial business with Brankas’ Open Finance Suite.

Join PERA HUB and other businesses and provide a faster, better experience to your end-users.