Join the BSP Open

Finance Pilot.

Let Brankas help with

submission.

Determine the readiness of your current API infrastructure for the Bangko Sentral ng Pilipinas (BSP) Open Finance Pilot.

Minimum requirements for Philippine banks and EMIs to qualify for the Open Finance Pilot:

Participating banks must complete the requisite infrastructure preparation, due diligence, and accreditation phases. This requires banks to have secure, reliable, and interoperable APIs for account aggregation, opening, payment initiation, and cancellation.

Banks will also have to demonstrate that their API infrastructure has adequate and secure testing, integration, documentation, and authentication capabilities.

Infrastructure

Comply with BSP-defined rules,

standards, processes, and

infrastructure.

Registration & Testing

Follow registration,

conformance testing, and

reporting processes.

Connectivity

Connect to the Pilot

infrastructure and other

participants when required.

Customer Consent

Obtain and manage customer

consent according to Pilot

standards and regulations.

Developer Portal

Provide a portal for API users to register and for customers to request services.

Reporting

Report to the Pilot Administrator and other relevant bodies.

Security

Ensure secure communication with API users according to Pilot standards.

API Standards

Offer APIs for subscription, account opening, payment initiation, and cancellation following specified standards.

Infrastructure

Comply with BSP-defined rules,

standards, processes, and

infrastructure.

Registration & Testing

Follow registration,

conformance testing, and

reporting processes.

Connectivity

Connect to the Pilot

infrastructure and other

participants when required.

Customer Consent

Obtain and manage customer

consent according to Pilot

standards and regulations.

Developer Portal

Provide a portal for API users to register and for customers to request services.

Reporting

Report to the Pilot Administrator and other relevant bodies.

Security

Ensure secure communication with API users according to Pilot standards.

API Standards

Offer APIs for subscription, account opening, payment initiation, and cancellation following specified standards.

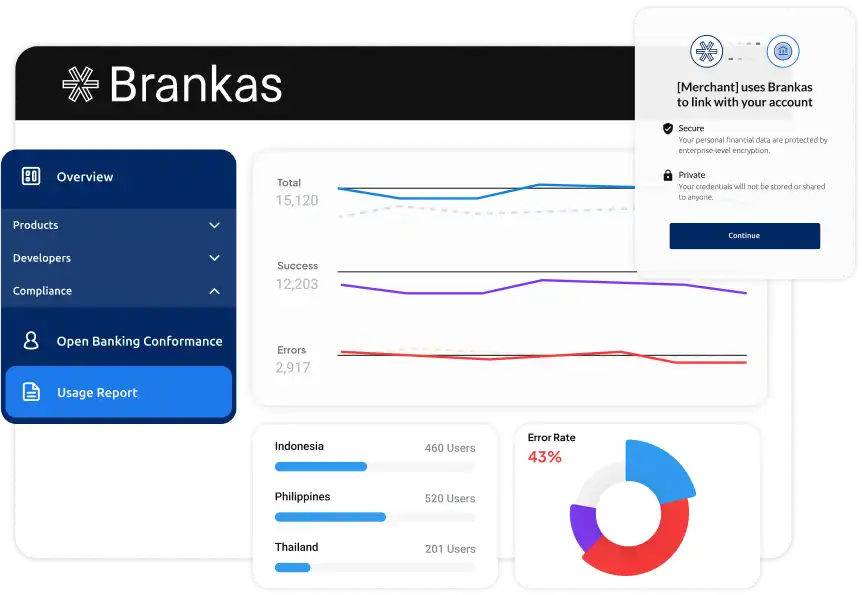

Brankas can help with an API infrastructure gap analysis and complete your application for the Open Finance Pilot.

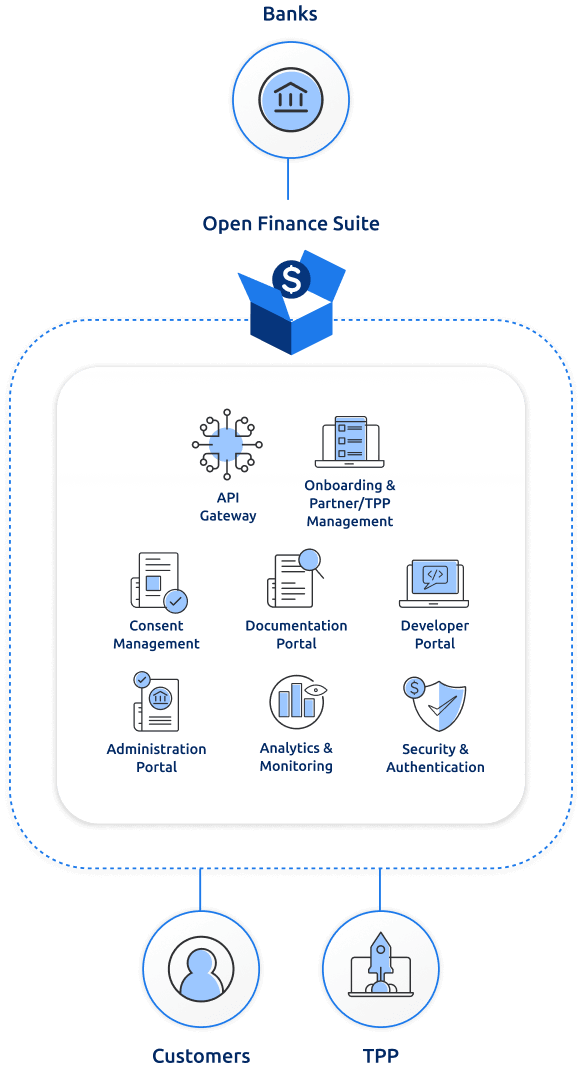

Brankas offers the only platform for Open Banking compliance and Banking-as-a-Service (BaaS) enablement. For cloud, on-premise, and hybrid deployments. Learn more about Open Finance Suite and our managed services below.

Hear it best from our clients.

Learn how you can accelerate your business with Open Finance.

Our vision is to empower our clients to deliver relevant and customer-centric products that positively impact the lives of customers, and we are proud to partner with a well-established open finance vendor like Brankas to help us achieve our goal.

Samer Soliman, Chief Executive Officer of Arab Financial Services (AFS)

Schedule a call with us today to start your gap assessment, or complete the form below.

Independent of the Open Finance Pilot, we can help any financial institution to prepare its API infrastructure or build BaaS offerings.

About the

BSP Open Finance Pilot

The activities of the PH Open Finance Pilot is governed by the provisions of BSP Circular No. 1122 on the Open Finance Framework, and monitored by the Open Finance Oversight Committee Transition Group (OFOC TG). This collaborative undertaking of financial institutions participating on a voluntary basis is an important initiative in promoting a responsive, inclusive and responsible digital financial ecosystem that is characterized by innovation-driven use of consumer data.

About the

BSP Open Finance Pilot

The activities of the PH Open Finance Pilot is governed by the provisions of BSP Circular No. 1122 on the Open Finance Framework, and monitored by the Open Finance Oversight Committee Transition Group (OFOC TG). This collaborative undertaking of financial institutions participating on a voluntary basis is an important initiative in promoting a responsive, inclusive and responsible digital financial ecosystem that is characterized by innovation-driven use of consumer data.

Related Sources